- BLA-324 - Ajman Boulevard Commercial, Al Jurf 2, Ajman - U.A.E.

- 0556982343 / 067792027

- info@bestbooksuae.com

What is our roles in Tax Audit?

The Tax Auditor may do the tax audit either by visiting the taxable persons’ location or by asking certain documents to submit to the authority for tax audit. It is the responsibility of a taxable person to comply with the requirements of the provisions of the tax laws. Bestbooks Accounting FZE LLC as TAX experts guide and support the taxable persons in the UAE to comply the tax requirements so that the business will be ready to face tax audit at any time by the authority. Our review of documents, systems and procedures of a taxable person on compliance of Tax laws is known as Tax Compliance Review.

How we proceed with VAT Compliance Review?

I. Accounting and operational software system review : Proper accounting software is mandatory in an organisation to ensure that it complies the UAE VAT law which will result that there is no discrepancy during a tax audit by a tax auditor. We check whether the accounting software used in the company is capable of handling:

- 1. Proper Tax Invoice

- 2. Proper Tax Credit Note

- 3. Proper Accounting on Reverse Charge (RCM while importing goods / services into the UAE)

- 4. Calculation of Output Tax

- 5. Recording of Input Tax

II. Review of compliance of Output Tax : Review of calculation of Output Tax includes the following:

- 1. Whether all taxable supplies at standard rated are charged at respective tax rate. (as of now 5%).

- 2. To ensure that only eligible zero-rated supplies are charged as zero-rated and proper supporting documents are maintained.

- 3. To ensure that out of scope supplies if any are accounted properly.

- 4. To check whether the goods imported into the UAE through UAE customs are recorded under Reverse Charge Mechanism

- 5. To reconcile the amount shown in FTA records as value of goods imported and the output liability on such imports with the records shown under the books of accounts.

- 6. To check whether the services if any imported from outside the UAE are recorded under Reverse Charge Mechanism.

- 7. To check whether only the eligible input credit are taken against such import of materials or goods under reverse charge mechanism.

- 8. To check whether exempted supplies if any are recorded and reported properly.

III. Review of compliance of Input Tax : Input tax claimed by the taxable person has to be properly reviewed to ensure that no discrepancies are detected during the tax audit. We exercise verification such as:

- 1. Whether only eligible input credits on purchases and expenses are claimed.

- 2. In the case of mixed supplies (exempted and zero rated / standard rated) whether the input credit is calculated as per the formula provided under the law.

- 3. Whether input credit on import of goods and services are calculated and claimed properly.

IV. Review of periodical VAT returns : Our tax experts will review the VAT Return files to be submitted to the authority and make sure that:

- 1. The entire output tax payable to the authority are recorded properly.

- 2. Only eligible amount is claimed as input credit.

- 3. The reporting of output tax under reverse charge are recorded properly.

- 4. Zero rated supplies and exempted supplies are recorded separately.

- 5. Additional reporting such as profit margin scheme, etc., are reported properly.

V. Payment of Tax due amount : to check whether the due tax amount is paid to the tax authority before the due date periodically.

Summary: Tax audit is the verification from the part of the Federal Tax Authority . Bestbooks Accounting FZE LLC as tax experts are available in all Emirates in the UAE to support and guide the entities to ensure that they comply the UAE VAT law, Excise tax law , for smooth functioning of a tax audit.

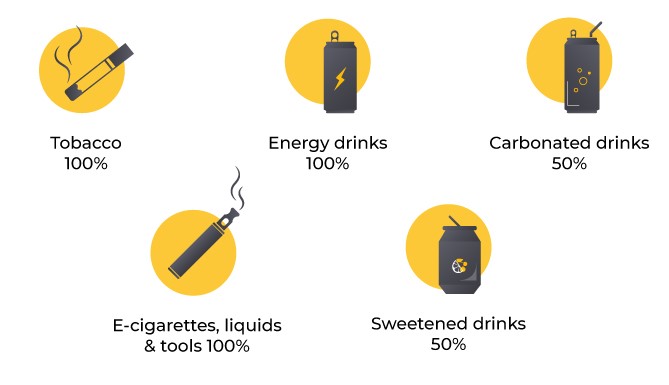

Which are the goods subject to the Excise Tax in the UAE?

Who should register for Excise Tax in the UAE?

The below-mentioned groups will now have to register for Excise Tax in the UAE

- Producers of Excise goods.

- Importers of Excise goods.

- Stockpilers of Excise goods.

- Warehouse keepers responsible for excise goods.

What are the information and documents to be given while registering for Excise Tax?

An applicant while registering for Excise Tax should provide following:

- Details of the applicant (name / legal type / other legal details)

- Contact Details

- Banking information

- Business Activity & related information

- Customs Registration details

- Declaration

Businesses are required to have the legal documents relating to the Entity.

For example:

- Trade License

- Certificate of Incorporation (if you have)

- Articles of Association

- Partnership Agreement

- Document of Ownership

- Emirates ID etc

- Customs Registration Document or Customs Number

- Power of Attorney if applicable

How can we support you?

Bestbooks Accounting FZE LLC Group are the TAX Experts providing VAT Consultancy, VAT Advisory and VAT Implementation Services in the UAE. We do support and guide the business community to register for Excise Tax in the UAE as well as advisory service on the compliance of UAE Excise Law. Overview of VAT in the UAE

GCC (Gulf Co-operation Council) countries have agreed ‘in principle’ to the GCC VAT Agreement to levy VAT (Value Added Tax) in the region. This will help the region to reduce their dependence on oil and other hydrocarbon products as a source of revenue. It is agreed by all the GCC countries that VAT will be introduced in every country latest by 1st January 2019. However, UAE decided to implement VAT likely w.e.f 1st January 2018.

We believe the decision to implement VAT would cause a paradigm shift in the business dynamics of the country as well as the region. Like most of the countries across the world, businesses in the Gulf region also will now have to adhere to stringent VAT regulatory and statutory compliances and report the same on a periodic basis. The challenge for the business community in the Gulf will be to understand the new VAT Law and implement the same well before the due date.

VAT is one of the most common types of consumption tax found around the world. Over 150 countries have implemented VAT. It includes the European Union (EU), UK, Canada, New Zealand, Australia, Singapore, Malaysia, India etc. USA, GCC countries and some other countries, especially from African continents, have not introduced VAT.

We are very much active on all social media platforms, you can also contact us here FACEBOOK, TWITTER and INSTAGRAM